So this is a market with a single buyer and seller.

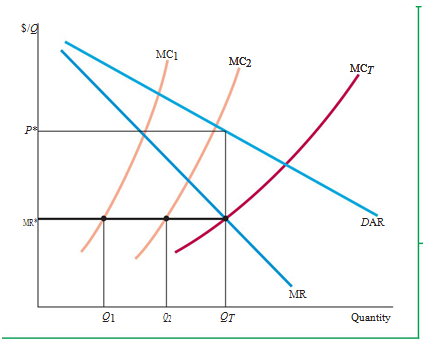

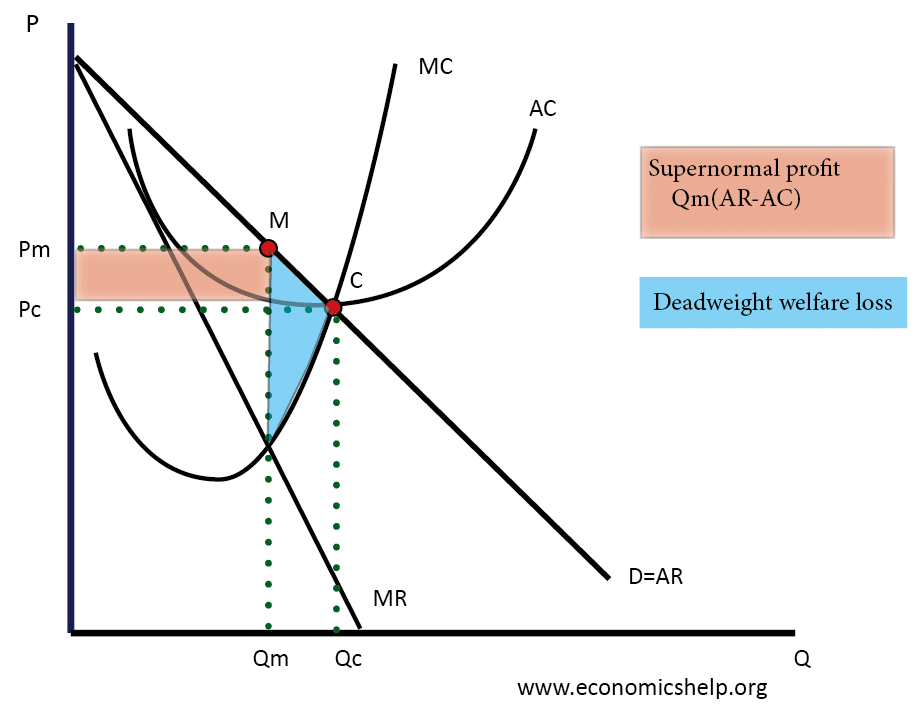

So the only thing you can buy is unionized labor and there's only one person buying it, the buyer of the monotony. So we could think of the labor union as pooling all of the resources together and selling just uh unionized labor. So excuse me, only one buyer in a market, right? A market with only one buyer and a labor union. We've discussed labor unions and monopolies. So we're gonna take what we've discussed in the previous couple of topics. However, Standard Oil could also be considered as a monopsony: being the biggest oil corporation in the US, it had incredible power when negotiating prices with its suppliers when acquiring parts for its refining factories.Alright now let's discuss the situation where there's only one buyer and one seller in the market. In 1911, the United States Supreme Court ruled that the company was an illegal monopoly. Consider as an example Standard Oil, back in the days before its breakup. The quantity sold will be very low ( Q BC) at a rather low price ( P BC).Ī bilateral monopoly can also be considered as a firm that has high negotiation power with its clients, which would get the firm to be considered as a monopoly, and high negotiation powers with its suppliers, which would mean the firm is also a monopsony. However, when the bargain power is equally shared between the two sides there may be joint profit maximisation, which can be done by colluding, or even vertical integration may occur if both firms merge, which would get both firms to jointly get an equilibrium corresponding to perfect competition ( C). A bilateral monopoly, however, will have worse results for both firms. When negotiation power is held by the supply side, the monopolistic firm will sell less quantity ( Q M) than the monopsonist would buy if it had more power ( Q m). When the demand side holds all the negotiation power we will be dealing with a monopsony-like situation such as m, where price P m is lower than the monopolist price ( P M) and the price of a perfectly competitive market ( P PC).

The obvious and antagonistic scenarios that can result in this market are monopsony and monopoly. The mine is monopolistic in producing lignite, and as the only buyer the power station acts as a monopsony.ĭepending on which side has greater negotiation power there can be different outcomes that resemble more or less its two extreme possibilities, as shown in the adjacent figure. Since transport of lignite is not economical, the power station is located close to the mine.

A peculiar example exists in the market for nuclear-powered aircraft carriers in the United States, where the buyer (the United States Navy) is the only one demanding the product, and there is only one seller (Huntington Ingalls Industries) by stipulation of the regulations promulgated by the buyer’s parent organization (the United States Department of Defense, which has thus far not licensed any other firm to manufacture, overhaul, or decommission nuclear-powered aircraft carriers).One example occurs when a labor union (a monopolist in the supply of labor) faces a single large employer in a factory town (a monopsonist).A bilateral monopoly model is often used in situations where the switching costs of both sides are prohibitively high. A market characterized by a single seller and a single buyer, otherwise known as a monopoly and a monopsony.Įxamples of a bilateral monopoly frequently occur in the public sector where a government education employer negotiates with a single teachers’ union on pay and conditions.īilateral monopoly situations are typically analyzed using the theory of Nash bargaining games, and market price and output will be determined by forces like bargaining power of both buyer and seller, with a final price settling in between the two sides’ points of maximum profit.

0 kommentar(er)

0 kommentar(er)